How much is Chris Squire worth? A look at the financial standing of a prominent figure.

An individual's net worth represents the total value of their assets, minus liabilities. This figure encompasses various holdings, including but not limited to real estate, investments, and personal possessions. Determining someone's net worth is a complex process often involving professional estimations, as certain assets may not have readily available market valuations. Publicly available information on such figures is usually limited, particularly for those who maintain a degree of privacy.

Understanding an individual's financial standing, in the case of a public figure or notable individual, can provide valuable context. Such insights offer potential perspectives on career trajectory, entrepreneurial success, and overall financial health within a particular field or industry. In some cases, a person's net worth is closely tied to their professional achievements or the value of their work in the public domain.

Read also:Exploring The Age Difference Between Eva Mendes And Ryan Gosling

| Category | Details |

|---|---|

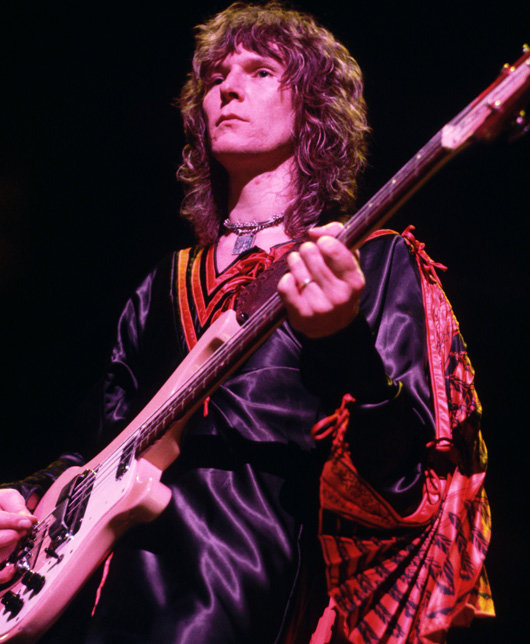

| Name | Chris Squire |

| Occupation | (Information to be added when available - e.g., musician, entrepreneur) |

| Industry | (Information to be added when available - e.g., music industry) |

| Notable Achievements | (Information to be added when available - e.g., Grammy nominations/wins, critical acclaim) |

This discussion will now proceed to analyze the financial status of Chris Squire in greater detail, providing relevant information and context.

Chris Squire Net Worth

Understanding Chris Squire's net worth involves examining various factors influencing financial standing. This includes income sources, asset valuation, and financial management strategies. A thorough analysis of these aspects provides valuable insights into the individual's overall financial health and success.

- Income Sources

- Asset Valuation

- Investment Strategies

- Expense Management

- Career Progression

- Public Information

- Private Financial Decisions

The net worth of individuals like Chris Squire, particularly public figures, is often multifaceted. Income sources, whether from music royalties, investments, or other ventures, directly contribute to the overall value. Accurate asset valuation is crucial, encompassing real estate, personal possessions, and more. Understanding investment strategies employed plays a role in assessing wealth accumulation and growth potential. Financial management practices and expenses affect the net worth's trajectory. Career progression influences income potential over time. Limited publicly available data underscores the necessity to consider both reported information and potential aspects not reflected in public records. Crucially, private financial decisions remain a significant element influencing net worth, often unobservable to the public.

1. Income Sources

Income sources directly impact an individual's net worth. The amount and consistency of income streams significantly influence the accumulation and maintenance of wealth. For figures like Chris Squire, income from primary employment, potentially including music royalties, licensing fees, or investment returns, forms a crucial component of their overall financial standing. Variations in income streams over time, such as fluctuating album sales or investment performance, are inherent aspects of such assessments. Consistent high-income sources, when managed effectively, contribute directly to a substantial net worth.

Consider the practical significance. Understanding the nature and diversification of income sources for musicians or individuals in similar fields allows for a nuanced appraisal of their financial health. This examination reveals potential income stability and the potential for wealth accumulation over time. For instance, substantial royalties from music, coupled with strategic investment decisions, can generate a significant net worth. Conversely, reliance on a single income stream with inherent volatility poses risks to overall financial stability. The evaluation process encompasses scrutinizing various potential income avenues, encompassing performance engagements, merchandise sales, or other forms of revenue generation.

In conclusion, income sources are critical elements in evaluating an individual's net worth. Their analysis reveals potential financial stability and the capacity for wealth accumulation. The diversity and consistency of income streams provide a crucial insight into the individual's overall financial health and are an important component for assessing a public figure like Chris Squire.

Read also:The Unique World Of Perus Rat Dish Culinary Tradition And Controversy

2. Asset Valuation

Accurate asset valuation is fundamental to determining Chris Squire's net worth. The process involves assessing the market value of various assets owned. This encompasses tangible assets such as real estate, vehicles, and personal possessions, as well as intangible assets, which might include intellectual property rights, stocks, and other investments. Precise valuation of these assets is crucial because variations in assessed value directly affect the overall net worth calculation. Discrepancies between appraised values and actual market prices can lead to inaccurate estimations. For instance, an undervalued property could lead to an underestimation of overall net worth, while a heavily overvalued collection of rare records could inflate the estimate, potentially creating a misleading picture.

The complexity of asset valuation arises from various factors, including the asset's type, condition, location, and market demand. Determining the precise worth of a musician's extensive record collection, for example, might necessitate expert appraisal to ascertain the historical significance, rarity, and current market demand. Similarly, evaluating a portfolio of investments, including stocks and bonds, demands constant monitoring of market fluctuations and expert financial advice. Accurate and current valuations are essential to reflecting the true financial standing of someone like Chris Squire, particularly considering the potential for appreciation or depreciation in the value of assets over time. The intricate process of valuing assets requires meticulous attention to detail and a deep understanding of the relevant market conditions.

In conclusion, asset valuation is an integral component of determining Chris Squire's net worth. Precise assessment of various assets, both tangible and intangible, is paramount to a comprehensive evaluation. Variations in asset valuation can significantly affect the overall calculated net worth. Understanding the complexities of valuation processes, including the impact of market fluctuations and the importance of expert appraisals, offers crucial insights into the intricacies of financial evaluations and the potential pitfalls in estimating net worth.

3. Investment Strategies

Investment strategies play a significant role in shaping an individual's net worth. Effective investment strategies can amplify wealth accumulation, while poor choices can lead to losses. The specific strategies employed, encompassing diverse financial instruments and risk tolerance levels, directly influence the trajectory of a person's financial standing. In the case of someone like Chris Squire, successful investment strategies, likely aligned with their risk tolerance and financial goals, would have contributed to the overall net worth figure.

The efficacy of investment strategies is crucial in achieving financial goals. Diversification, a key strategy, involves spreading investments across various assets to reduce risk. Strategic asset allocation, another important aspect, involves deciding how much capital to allocate to different asset classes, such as stocks, bonds, and real estate. Furthermore, the timing of investments and the ability to adapt to market fluctuations are critical elements. For instance, consistent investment in low-cost index funds or strong dividend-paying stocks could steadily enhance net worth over time. Conversely, speculative investments with high potential returns often carry increased risk. The success or failure of investment strategies directly correlates with the eventual net worth accumulation.

In conclusion, investment strategies are integral to determining an individual's net worth. By understanding and implementing sound strategies, individuals can increase the likelihood of achieving their financial goals and ensuring that their wealth grows over time. The success of investment decisions has a direct impact on an individual's financial status. The ability to adapt and adjust strategies in response to market conditions is equally important for sustained financial growth. The specific strategies employed by someone like Chris Squire, if known, would further clarify the factors contributing to their net worth.

4. Expense Management

Effective expense management is a critical component in building and maintaining a substantial net worth. Controlling expenditures directly influences the amount of capital available for investment and accumulation. Expenditures, whether for necessities or discretionary items, inevitably reduce available resources. Careful allocation of funds, prioritizing essential expenses, and implementing strategies for cost reduction contribute directly to increased net worth over time. A disciplined approach to expense management allows for a more substantial portion of income to be allocated toward investment and savings, enabling faster growth and improved overall financial health. In the case of a prominent individual like Chris Squire, meticulous expense management alongside savvy investment choices likely played a crucial role in achieving their financial standing.

The importance of expense management extends beyond merely saving money. It reflects a broader financial strategy, encompassing budgeting, tracking spending, and proactively identifying areas for potential cost reduction. Analyzing spending patterns reveals areas for improvement and allows for the establishment of realistic financial goals. This involves a commitment to living within one's means, prioritizing essential expenses, and consistently identifying and curbing unnecessary expenditures. Examples of practical expense management strategies include creating a budget, utilizing expense tracking apps, negotiating bills and services, and reducing unnecessary subscriptions. For individuals earning substantial income, disciplined expense management is crucial for maintaining a healthy net worth and avoiding costly errors. Consistent tracking and meticulous review of spending habits can provide insights for future adjustments to spending patterns.

In conclusion, effective expense management is an integral element for achieving and maintaining a strong net worth. It directly impacts the accumulation of wealth by influencing the amount available for investment and savings. Prioritizing essential expenses and implementing cost-reduction strategies are key components of a comprehensive financial strategy. By meticulously managing expenses, individuals can maximize their financial potential and set the stage for future financial success, a principle applicable to anyone, including Chris Squire. This principle also underlines the importance of financial literacy and responsible financial decision-making as crucial elements in wealth-building.

5. Career Progression

Career progression significantly impacts an individual's net worth. A successful and sustained career often correlates with increasing earning potential, leading to greater savings and investment opportunities. The evolution of a career, encompassing advancements, changes in roles, and overall industry impact, directly shapes financial outcomes over time.

- Early Career Earnings and Growth

Early career stages frequently involve lower salaries and limited opportunities for high-earning positions. However, early career choices and professional development activities, like acquiring essential skills or specialized knowledge, lay the groundwork for future financial success. Consistent learning and seeking opportunities for advancement, during this phase, often pay substantial dividends in the long run. This can manifest in higher earning potential within the chosen career path.

- Industry Recognition and Impact

Recognition within a specific industry, achieved through contributions or specializations, typically leads to higher compensation and more lucrative opportunities. Influential contributions to the field, exemplified by publications, leadership roles, or innovative projects, often elevate earning potential. This influence can directly correlate with a professional's economic value and hence, net worth. Notable achievements in the field can open doors to increased income.

- Skill Development and Adaptation

Adapting to industry changes and acquiring relevant new skills are vital aspects of career progression. Maintaining expertise and updating skills to align with evolving industry needs is essential for long-term professional success. Individuals who consistently upskill remain competitive, potentially commanding higher salaries and securing higher-paying employment opportunities. This adaptability directly connects with career trajectory and financial advancement.

- Career Transitions and New Opportunities

Career transitions, driven by market shifts, personal aspirations, or skill enhancement, can significantly affect net worth. Strategic career changes, often involving higher-paying roles or new industries, can lead to immediate increases in income and wealth accumulation. However, these transitions require careful consideration to ensure financial stability and avoid potential setbacks during the transition phase. Evaluating career options and potential earning prospects is crucial for effective transitions and ensuring improved financial outcomes.

In summary, career progression is a pivotal factor in determining financial success. From early career development to industry recognition and adaptive skill building, a strong career trajectory directly influences earning potential and investment capacity. These factors collectively contribute to overall wealth accumulation and, thus, impact an individual's net worth.

6. Public Information

Public information plays a crucial role in understanding an individual's net worth. Availability and accessibility of data regarding financial transactions, career history, and assets provide a foundation for estimations. However, the completeness and accuracy of this data are not always guaranteed and can affect the accuracy of net worth assessments. This section delves into the types of public information relevant to determining net worth estimations.

- Financial Records (Limited Access)

Limited financial records are publicly available for individuals like Chris Squire. Financial statements, tax returns, or detailed investment portfolios are typically not open to the public unless required by law or voluntarily disclosed. Publicly available data may only include basic financial information, which may not accurately reflect the total value of assets. Any such details found need careful interpretation.

- Public Records (e.g., Property Records)

Property records, accessible through public registries, provide insights into real estate holdings. Details about properties owned, including purchase dates, values, and associated mortgages, can be crucial elements in estimating an individual's net worth. This facet of public information, however, doesn't encompass all assets; it represents a piece of the larger financial picture. Other types of assets, such as private investments, might not be recorded.

- Career History and Income (Potential Insights)

Publicly available information about a person's career, including employment history, salary details (if reported publicly), and industry recognition, can provide a degree of insight into potential income levels and earning capacity. However, this information may not be exhaustive and doesn't fully represent all sources of income. The accuracy of this data and its consistency throughout the career remain important factors.

- Media Reports and Public Statements (Potential Biases)

Media coverage and public statements by individuals can sometimes offer hints about financial matters. News articles, interviews, or other public pronouncements might include references to assets, investments, or financial situations. These sources must be treated with caution as they can be subject to interpretation and possible bias. The information gleaned is not necessarily comprehensive or accurate.

In conclusion, while public information offers a glimpse into the possible financial standing of individuals like Chris Squire, its completeness and reliability are often limited. The inherent limitations of publicly available data necessitate careful interpretation and analysis. Combining several sources of public information, where available, can offer a more nuanced view but should not be considered the sole basis for a precise net worth calculation. The value of such public information should be considered in context with other possible sources of data and relevant assessments.

7. Private Financial Decisions

Private financial decisions exert a significant influence on an individual's net worth. These choices, often undisclosed publicly, encompass a wide range of actions, from investment strategies to spending habits and estate planning. They represent crucial factors shaping the overall financial picture of someone like Chris Squire, even when not explicitly documented.

- Investment Choices and Portfolio Management

Investment decisions, often tailored to personal risk tolerance and financial goals, significantly impact net worth. These decisions might include diversification strategies, specific investment vehicles, and the timing of transactions. The success of these strategies, which may not be publicly known, can drastically affect the accumulation or erosion of wealth over time. For example, early investment in high-growth sectors or astute real estate acquisitions can substantially increase net worth, while poorly-timed or ill-advised investments can lead to substantial losses.

- Spending Habits and Discretionary Expenses

Personal spending habits, regardless of income level, are crucial in shaping net worth. The balance between essential expenses and discretionary spending directly affects the amount available for savings, investments, or other wealth-building activities. Strategic financial management and prioritizing savings contribute to the growth of net worth, while excessive spending can hinder accumulation and lead to a reduction in financial assets.

- Estate Planning and Legacy Considerations

Private estate planning decisions often involve intricate strategies for asset distribution and long-term financial security for heirs or dependents. Careful planning, through wills, trusts, and other legal instruments, can secure the financial future of loved ones while optimizing the distribution of assets. These decisions, although not immediately reflected in the current net worth calculation, ultimately contribute to the long-term financial picture and overall wealth management. These decisions can significantly affect how assets are transferred and managed in the future.

- Tax Strategies and Financial Advice

Personal tax strategies and utilization of financial advisors can greatly influence net worth. Implementing effective tax strategies to minimize tax liabilities and seeking professional financial advice can be crucial in maintaining and building wealth. These decisions, conducted in the private realm, impact the efficiency of asset management and the overall effectiveness of financial strategies.

In conclusion, the private financial decisions of individuals like Chris Squire, while often unseen, directly influence their net worth. The strategic choices made regarding investments, spending, estate planning, and financial guidance are critical components in building or protecting wealth, regardless of the size of the initial holdings. By understanding the multitude of private factors at play, a more holistic and comprehensive picture of net worth emerges, recognizing that publicly available data often provides only a partial view.

Frequently Asked Questions about Chris Squire's Net Worth

This section addresses common inquiries regarding the financial standing of Chris Squire. Accurate estimations of net worth are often complex, influenced by various factors that are not always readily apparent or publicly available. These questions aim to clarify some of the ambiguities surrounding this topic.

Question 1: How is net worth determined for someone like Chris Squire?

Determining net worth involves assessing total assets, including but not limited to real estate, investments, and personal possessions. Subtracting liabilities, such as debts and outstanding loans, yields the net worth figure. Accurate valuations for various assets can be complex, especially for individuals with diverse holdings. Public information, while helpful, may not encompass the entirety of an individual's financial portfolio.

Question 2: What are the primary sources of income for musicians like Chris Squire?

Musicians' income streams are diverse and can include album sales, streaming royalties, touring, merchandise, licensing fees, and potentially investment returns. The relative contribution of each source can fluctuate, influenced by factors such as album release cycles, tour schedules, and market trends. The specific income profile of an artist like Chris Squire would depend on the distribution of these income streams.

Question 3: Why is public information about net worth often incomplete or inaccurate?

Publicly accessible information regarding net worth is frequently incomplete due to the private nature of financial matters. Individuals may not disclose their financial positions fully, particularly if they wish to maintain privacy. Moreover, valuation of certain assets can be subjective and vary according to market conditions. The absence of comprehensive records makes complete and precise estimations challenging.

Question 4: How do investment strategies affect an individual's net worth?

Effective investment strategies are crucial for wealth accumulation and preservation. Successful diversification and strategic asset allocation can enhance net worth over time. Conversely, poorly executed or inappropriate investment choices can lead to significant losses. The long-term impact of investment decisions, both public and private, directly correlates to an individual's overall financial health.

Question 5: Can expense management practices influence net worth?

Expense management is a significant factor influencing net worth. A disciplined approach to spending, including budgeting, tracking expenses, and prioritizing essential needs, allows for greater savings and investment opportunities. Conversely, extravagant spending habits can deplete assets and impede wealth accumulation.

In summary, estimating someone's net worth necessitates a nuanced understanding of their income sources, asset valuations, investment strategies, expense management, and relevant publicly available data. The complexity of these factors makes precise calculations challenging, and public information often provides only a partial picture.

This section provides a foundational understanding of the complexities of evaluating net worth. The following section explores specific details regarding Chris Squire's career and achievements.

Conclusion

Determining Chris Squire's net worth proves a complex undertaking. Public information regarding financial details is often limited, necessitating careful consideration of various factors. Income sources, including music royalties and potentially other ventures, are significant contributors to overall financial standing. Accurate asset valuation, encompassing tangible and intangible holdings, plays a crucial role. Effective investment strategies and disciplined expense management are key drivers in wealth accumulation. However, the private nature of financial decisions and the absence of comprehensive public records make precise estimations challenging. Career progression, impacting earning potential and influencing future income streams, is another crucial component. Ultimately, a comprehensive understanding of Chris Squire's net worth requires careful evaluation of multiple, often incomplete, data points.

While a precise figure remains elusive, this exploration highlights the interconnectedness of various factors contributing to an individual's financial status. Further analysis of specific financial data, when available, could offer a more definitive understanding. The study emphasizes the complexity and often subjective nature of such assessments, highlighting the limitations of publicly accessible information and the need for careful interpretation of available data in such cases. Understanding the nuances of calculating net worth is vital, especially in the context of public figures. The pursuit of a comprehensive evaluation fosters a deeper understanding of financial complexities and the factors influencing the economic trajectory of individuals.

Article Recommendations