What drives the performance of the publicly traded robotics company's shares? A look at the factors influencing its stock price.

The publicly traded shares of a robotics company represent ownership stakes in the business. Changes in the market value of these shares, reflected in stock prices, are influenced by a multitude of factors, including financial performance, investor sentiment, and broader market trends. For instance, positive earnings reports or successful product launches might result in higher share prices, while negative news or industry downturns can lead to declines.

The performance of a robotics company's stock often correlates with its ability to innovate, secure contracts, and manage expenses effectively. Factors like technological advancements in robotics, the growth of the relevant market sectors, and competitive pressures are crucial. Historically, the robotics industry has exhibited periods of significant growth interspersed with consolidation and adjustments. This dynamic environment, along with the specific business strategy of the company, contributes to fluctuating stock prices. Successful ventures in new markets or expansion of existing markets can create positive momentum and attractive returns for investors. Conversely, setbacks in development or market acceptance may lead to reduced investor confidence and lower stock valuations. Overall, the company's performance is a key determinant of investor perception and, subsequently, the stock price.

Read also:Scoop Leaked Lilly Philips Content Exposed

Moving forward, a detailed examination of the company's financial performance, product portfolio, and market position is crucial for understanding the investment potential and risks associated with the company's stock. Analysts' forecasts and opinions will also provide additional context.

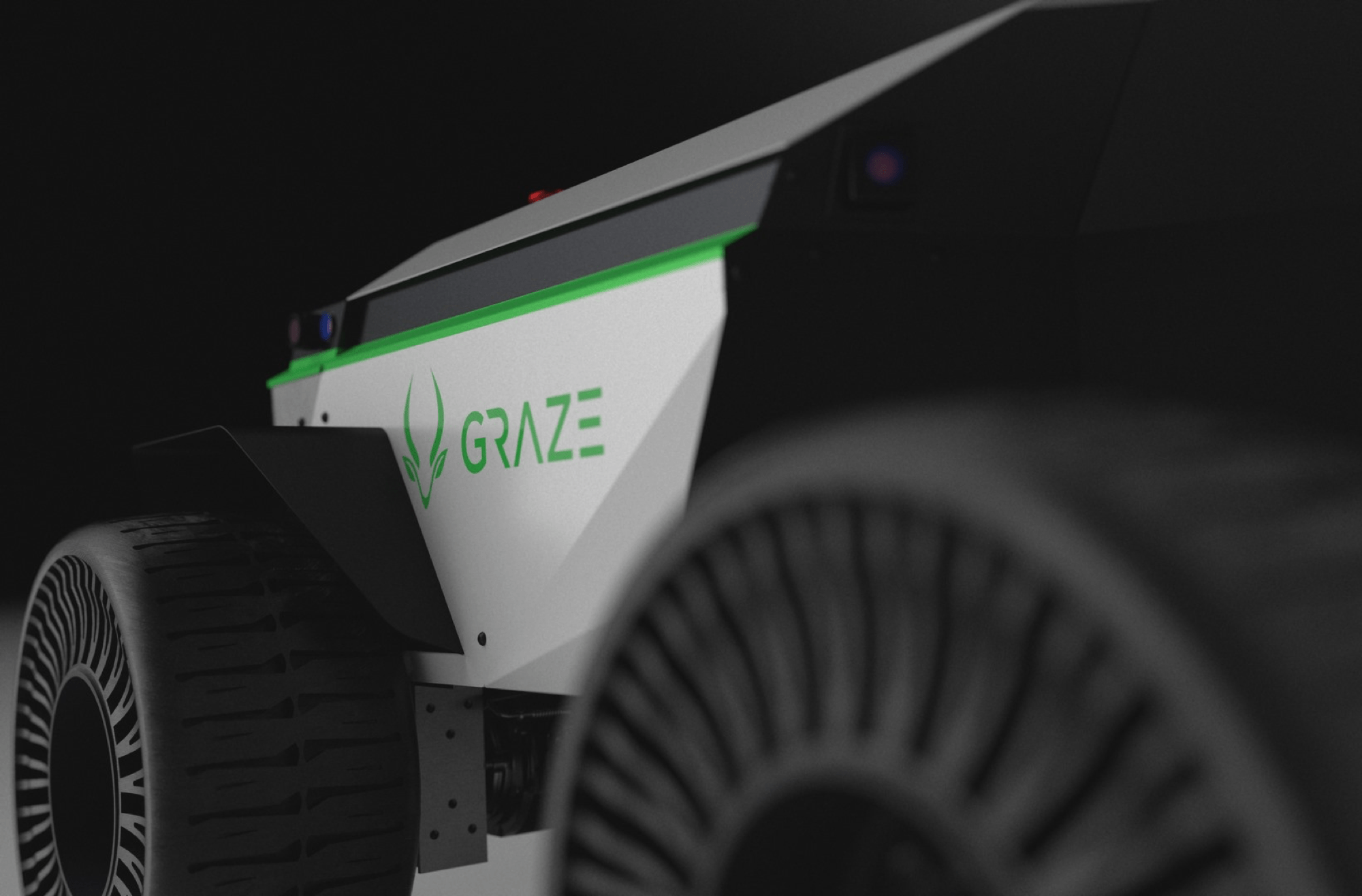

Graze Robotics Stock

Understanding the factors influencing Graze Robotics stock requires a multifaceted approach. Analyzing key aspects offers a more complete picture.

- Financial Performance

- Market Trends

- Industry Growth

- Technological Advancement

- Competitive Landscape

- Investor Sentiment

- Company Strategy

- Analyst Projections

Graze Robotics stock performance hinges on a complex interplay of factors. Strong financial results, coupled with positive market trends and industry growth, can drive up the stock price. Simultaneously, rapid technological advancement and a competitive market landscape can create both opportunities and risks. Investor sentiment, often influenced by analyst projections, significantly impacts stock value. Ultimately, a thorough examination of each componentfrom financial performance and market trends to the companys competitive strategy and analyst forecastsprovides a comprehensive understanding of the factors affecting the stock's price movement. For example, consistent profitability and expansion into new markets can bolster investor confidence and potentially lead to rising stock prices. Conversely, a drop in industry demand or intense competition might pressure the stock price.

1. Financial Performance

Financial performance directly influences the value of a company's stock, including Graze Robotics. Profitability, revenue growth, and operational efficiency are crucial indicators. Positive financial results typically lead to increased investor confidence and a higher stock price. Conversely, negative financial performance can trigger investor concern and cause stock prices to fall. Consistent profitability demonstrates a company's ability to generate returns, thereby attracting investment and supporting price appreciation.

Consider a company consistently exceeding earnings expectations. This signals robust operations, potentially driving demand for shares and boosting the stock price. Conversely, if a company reports declining profits or significant losses, investors may perceive the business as less attractive, leading to a decrease in stock value. For example, successful product launches that generate higher revenue and profit margins often lead to investor optimism. The opposite, such as significant cost overruns or difficulties in scaling production, might result in negative market sentiment. Understanding the link between financial performance and stock price is crucial for informed investment decisions, as it allows investors to gauge the health and potential of a company.

In summary, a company's financial health is a primary driver of its stock performance. Positive financial results generally correlate with higher stock prices, while negative performance often results in downward pressure. Understanding these relationships allows investors to evaluate investment prospects and assess risk more effectively. Investors must analyze financial statements, including income statements, balance sheets, and cash flow statements, to form informed judgments about a company's financial health and its potential for future success, and how this relates to the stock's worth.

Read also:Stylish Long Face Hairstyles For Men Enhance Your Look

2. Market Trends

Market trends play a significant role in shaping the trajectory of robotics company stocks like Graze Robotics. Positive trends in the broader robotics sector, such as increased automation adoption across various industries, can positively influence the stock price. Conversely, adverse market conditions, including economic downturns or shifts in investor sentiment, can lead to negative stock price fluctuations. The correlation between market sentiment and stock price is evident in historical data. For example, during periods of general market optimism, speculative investment in innovative sectors, including robotics, tends to increase, leading to higher stock valuations. Conversely, economic uncertainty or specific industry concerns can cause investors to pull back from riskier investments, negatively impacting company stock prices.

The impact of market trends extends beyond general economic conditions. Specific trends within the robotics industry itself exert considerable influence. For example, the emergence of a particular type of robotic application, or advancements in robotics technology, can trigger increased investment in related companies like Graze Robotics. This would reflect in heightened interest and higher valuations for companies directly benefiting from those developments. Conversely, if a particular application proves less viable than predicted, or competitors introduce innovative alternatives, the market response might be negative. The significance of market trends is magnified by the cyclical nature of technological advancements, and the dynamics of competitive pressures.

Understanding market trends is crucial for evaluating the potential investment prospects for Graze Robotics stock. Analyzing historical performance in relation to market conditions allows investors to gauge the susceptibility of the stock to broader market forces. Forecasting future market trends, through factors like technological advancements, industrial shifts, and broader economic conditions, is a key element in developing investment strategies. For instance, investors might anticipate increased demand for collaborative robots in specific sectors, impacting the success and ultimately, the stock valuation, of companies like Graze Robotics. In conclusion, the interplay between market trends and robotics company stocks, such as Graze Robotics, is a dynamic relationship that requires ongoing assessment and adaptability for informed decision-making. Market volatility, driven by unforeseen events or rapid technological shifts, can heighten the risks associated with investment, demanding prudence and thoughtful consideration of risk factors.

3. Industry Growth

Industry growth significantly impacts a robotics company's stock performance. A burgeoning robotics sector often correlates with increased demand for related technologies and services. Positive industry trends can boost investor confidence and drive stock prices higher. Conversely, stagnant or declining industry growth can lead to lower stock valuations. This analysis examines key aspects of industry growth and their relationship to a robotics company's stock.

- Market Expansion and Adoption

Rapid expansion of robotics applications in various industries (e.g., manufacturing, logistics, healthcare) translates into greater demand for robotics solutions. Increased adoption translates directly into potential for revenue growth for robotics companies. If, for example, the demand for automated warehousing systems rises significantly, companies like Graze Robotics whose products address this need could see a corresponding improvement in stock price. Conversely, limited market penetration or a lack of widespread adoption could reduce demand and impact a company's stock negatively.

- Technological Advancements

Breakthroughs in robotics technology, particularly in areas like artificial intelligence and sensor integration, often drive the creation of new applications and expand the scope of use. This spurs innovation and higher market demand, benefitting companies like Graze Robotics if their technology aligns with these advances. Conversely, if the company fails to adapt to or adopt these advancements, it risks lagging behind competitors and potentially losing market share, which can negatively affect stock performance.

- Government Policies and Regulations

Government policies that encourage automation, investment in research, and standardization of robotic systems have a demonstrable effect on market growth. Favorable policies can support industry expansion and raise the demand for robotics. Companies benefiting from these policies may see their stock values rise. Conversely, policies that hinder robotics development or increase regulatory burdens might slow or reverse market growth, potentially leading to a decline in stock valuation.

- Competitive Landscape

The dynamism of the robotics industry is shaped by the competitive landscape. Increased competition necessitates innovation and cost-efficiency for companies like Graze Robotics. Robust competition can, at times, provide a larger market for the industry as a whole. A rising tide can lift all boats, but fierce competition with rapidly emerging competitors could negatively affect Graze Robotics' stock price if it falls behind in innovation or market penetration. Successful strategies for competing in a dynamic marketplace will be crucial for maintaining the company's market position, which affects investor confidence and therefore, its stock valuation.

In conclusion, the growth of the robotics industry directly impacts the performance of companies like Graze Robotics. Understanding the drivers of this growth, such as market expansion, technological advancements, governmental policies, and competitive pressures, is essential for evaluating the potential for future success and predicting the likely direction of a company's stock. Analysis of these factors in relation to Graze Robotics' specific capabilities and strategies will provide a more complete picture of its future investment potential.

4. Technological Advancement

Technological advancements are fundamental to the success and valuation of robotics companies like Graze Robotics. Innovations directly impact a company's product capabilities, market competitiveness, and ultimately, its stock performance. The pace and nature of these advancements dictate how a company can adapt, innovate, and maintain a leading position in the field. Understanding these technological drivers is crucial for evaluating investment potential.

- Automation and AI Integration

Advancements in automation and artificial intelligence (AI) are transforming the robotics industry. AI-powered systems allow robots to perform complex tasks with greater precision and adaptability. This translates to increased efficiency and productivity, directly affecting a company's cost structure and output. Graze Robotics, for example, would benefit from AI enhancements to their robotic systems that improve navigation, object recognition, and decision-making in dynamic environments. The impact on stock valuation is positive if these technologies translate to improved profitability and reduced operating costs.

- Sensor Technology and Data Processing

Sophisticated sensor technology, coupled with advanced data processing capabilities, allows robots to perceive and interact with the physical world with greater accuracy and intelligence. Improved sensor feedback, for instance, enables robots to better adapt to changing environments and execute tasks more precisely. In the context of Graze Robotics, advanced sensors could translate to more reliable and efficient robotic operations, potentially leading to higher output and profitability. The stock could reflect this technological improvement in positive valuations.

- Robotic Arm and End-Effector Evolution

Continued development of robotic arms and end-effectors, including improvements in dexterity, strength, and precision, leads to increased applicability in various sectors. Graze Robotics would potentially benefit from advances in the designs and functionalities of the manipulator arms and end-effectors of their robots. If these enhancements empower their robots to perform more intricate and complex tasks, the companys market position and potential for expansion could improve, driving increased investor confidence and stock value.

- Materials Science and Robotics Construction

Advancements in materials science directly impact robot construction. Lightweight, durable, and cost-effective materials contribute to improved robot performance and accessibility. Changes in materials can result in faster or more energy-efficient robots. Graze Robotics' stock performance can reflect positively on the market's perception of the company's ability to adapt and develop its product line using these improved materials. This results in cost-effective production and enhanced product performance, potentially increasing investor interest and driving stock prices.

In summary, technological advancement is a key driver influencing the trajectory of Graze Robotics stock. Innovations in automation, sensing, robotic arms, and materials science directly affect the company's capabilities, market position, and profitability. Understanding these technological advancements is crucial for investors to assess the future potential of the stock, enabling informed investment decisions. For example, if Graze Robotics strategically incorporates the latest technological advances, this could lead to a positive perception among investors, increasing the company's market share and ultimately driving up stock value.

5. Competitive Landscape

The competitive landscape significantly influences a robotics company's stock performance. A company's ability to navigate this landscape, adapt to evolving market dynamics, and maintain a competitive edge directly affects investor sentiment and, consequently, stock valuation. A robust competitive position, demonstrated by market share, innovative products, and strong financial performance, often translates to higher investor confidence and a rising stock price. Conversely, a weakening competitive stance, due to lagging innovation or a loss of market share, typically results in investor apprehension and potential stock decline. This relationship holds true for Graze Robotics stock, as any changes in the competitive landscape can directly impact its valuation.

Consider the impact of new entrants into the robotics market. If a competitor introduces significantly improved or more cost-effective technology, Graze Robotics needs to adapt or risk losing market share. This competitive pressure can translate into decreased profitability, reduced investor interest, and potentially a drop in the stock's value. Conversely, if Graze Robotics successfully differentiates its products through innovation, such as developing unique applications for its robots or achieving superior operational efficiency, this can enhance their competitive position, potentially leading to increased investor confidence and higher stock valuations. Existing competitors also influence the landscape. Successful ventures by established rivals in the robotics industry can affect the perception of the entire sector and possibly the overall risk associated with investment in Graze Robotics stock. Furthermore, a shift in customer preference or demand in robotics applications can trigger changes in the competitive landscape that influence the success and, consequently, the stock valuation of companies like Graze Robotics.

Understanding the competitive landscape is crucial for investors evaluating Graze Robotics stock. Detailed analysis of competitor strengths, weaknesses, innovations, market strategies, and financial performance provides context for assessing Graze Robotics' position. The ability to anticipate potential competitive threats and capitalize on emerging opportunities is essential for informed investment decisions. Analyzing competitive trends, market shares, and industry reports is crucial to gauging how these forces will affect Graze Robotics' performance and, ultimately, its stock price. Monitoring the activities of key competitors, along with anticipating potential new entrants into the robotics market, is critical for proactively evaluating investment risks and rewards connected to Graze Robotics stock. Without a clear understanding of this aspect, investors may fail to appreciate the full picture of risk and potential return involved in any investment in Graze Robotics stock. Ultimately, a strong competitive position translates to a more attractive investment opportunity, while a weakening position creates greater risk. This understanding is essential for evaluating the investment potential and risk of Graze Robotics stock in relation to the broader competitive market.

6. Investor Sentiment

Investor sentiment, the collective attitude and emotional outlook of investors toward a particular company or stock, plays a significant role in shaping the price of Graze Robotics stock. This sentiment, influenced by a multitude of factors, can fluctuate rapidly and exert considerable upward or downward pressure on share values. Understanding the drivers behind investor sentiment is vital for evaluating the potential investment landscape of Graze Robotics and interpreting stock price movements.

- Market Perception of Innovation

Investors frequently attribute greater value to companies perceived as innovative or at the forefront of technological advancement. Positive news related to technological breakthroughs, successful product launches, or advancements in the robotics industry can elevate investor sentiment and potentially drive up the stock price. Conversely, if Graze Robotics is perceived as lagging behind competitors in innovation, or if their technology faces significant challenges, investor confidence may decrease, leading to a downward pressure on the stock price.

- Company Performance and Financial Reports

Financial performance is a cornerstone of investor sentiment. Strong quarterly earnings, revenue growth, and indications of profitable operations will often bolster confidence and lead to positive investor sentiment, reflected in a rising stock price. Conversely, disappointing results, significant losses, or indications of financial strain can negatively impact sentiment and lead to a decline in share value. Investors frequently scrutinize financial reports for indications of the company's financial health and its future prospects.

- Industry Trends and Market Conditions

The broader robotics industry and general economic climate also influence investor sentiment. A flourishing robotics market, characterized by increasing adoption and positive industry news, tends to fuel investor optimism regarding Graze Robotics. However, an economic downturn or a general decline in interest in robotics can lead to apprehension among investors, potentially lowering the valuation of Graze Robotics stock. Changes in regulatory environments impacting robotics development and applications should also be factored into assessing industry trends.

- Analyst Ratings and Predictions

Financial analysts' ratings and predictions carry considerable weight in shaping investor sentiment. Positive ratings or optimistic predictions often attract increased investor interest and potentially drive up stock values. Conversely, negative ratings or pessimistic forecasts can create hesitation among investors, leading to lower stock prices. The influence of analysts on investor sentiment should be viewed in context with their potential biases or limitations.

In summary, understanding investor sentiment is crucial for navigating the complexities of investing in Graze Robotics stock. By recognizing the interplay of factors like innovation perception, financial performance, industry trends, and analyst opinions, investors can better interpret market signals and potentially make more informed decisions. Investors must remain cognizant of the potentially volatile nature of investor sentiment and its impact on short-term stock fluctuations. Historical data on market reactions to similar events within the robotics sector can be helpful for predicting future stock price movements.

7. Company Strategy

A company's strategic choices significantly impact its stock performance. For a robotics company like Graze Robotics, strategy dictates how it allocates resources, identifies market opportunities, and develops its products. These strategic decisions directly influence investor perception and, consequently, the stock's value. A well-defined and effectively executed strategy can lead to increased investor confidence and a rising stock price, while a poorly conceived or implemented strategy can result in declining share value.

- Product Development and Innovation

The company's approach to product development directly affects its market position. A proactive strategy that prioritizes innovation and adapting to emerging technologies can create a competitive edge, attract customers, and generate strong revenue growth. Examples include investing in research and development, acquiring innovative technologies, or developing new robotic applications. Successfully introducing new robotic solutions that address specific market needs can result in increased investor confidence and a higher stock valuation. Conversely, a stagnant product line or a failure to adopt technological advancements can diminish market appeal and negatively impact stock performance.

- Market Segmentation and Targeting

Strategic decisions regarding market segmentation and targeting can significantly influence the company's growth trajectory. Clearly identifying target customer segments and tailoring products and marketing efforts to those segments can maximize efficiency and optimize resource allocation. For example, focusing on specific industries where robotics demand is high or developing specialized robotic solutions for niche markets can increase market penetration and enhance profitability. A poorly defined or misaligned market strategy can lead to missed opportunities, decreased revenue, and lower investor confidence.

- Operational Efficiency and Cost Management

Optimizing operational efficiency and managing costs effectively are critical for profitability and sustainable growth. A strategic focus on streamlining production processes, reducing overhead, and improving supply chain management can enhance profitability and return on investment. Efficient operations often lead to better financial performance, positively influencing investor sentiment and potentially increasing the stock price. Inefficient operations or poor cost management can negatively impact the company's financial health, leading to reduced investor confidence and potentially lower stock prices.

- Financial Management and Investment Strategy

Strategic decisions concerning capital allocation, debt management, and financial forecasting play a crucial role in long-term sustainability and value creation. A well-defined financial strategy that prioritizes responsible debt management, allocates capital effectively to research and development, and projects future revenue streams can positively affect the company's financial health, leading to increased investor confidence and potentially higher stock prices. Conversely, poor financial planning, inappropriate debt levels, or an inability to predict future revenue streams can harm the company's financial standing, potentially leading to a decline in stock value.

In conclusion, Graze Robotics' overall strategy directly influences its stock price. A robust strategy, encompassing product innovation, targeted market entry, operational excellence, and sound financial management, fosters investor confidence and enhances the potential for long-term value creation. Conversely, a deficient strategy can hinder the company's progress and damage its stock performance. Consequently, understanding and evaluating the strategic decisions made by Graze Robotics is crucial for evaluating its investment potential and risk.

8. Analyst Projections

Analyst projections significantly influence the market perception and, consequently, the stock price of companies like Graze Robotics. These projections, often expressed as forecasts for future financial performance, represent expert opinions on a company's potential growth and profitability. Their impact stems from the influence they exert on investor sentiment and decision-making, directly impacting the stock's valuation.

- Accuracy and Reliability

The accuracy and reliability of analyst projections are critical. Precise and well-reasoned forecasts based on thorough research and a deep understanding of the company, industry trends, and market conditions build investor confidence. Conversely, inaccurate or overly optimistic projections can erode investor trust and lead to a decline in stock value. The ability to predict future performance with accuracy is essential in judging the reliability of an analyst report, as unreliable analysis can mislead investors. For example, consistently accurate predictions from a particular analyst may increase their influence over investors' decisions and thus affect the stock price.

- Consensus and Divergence

The consensus among analysts provides a broader perspective on the stock's future. A strong consensus of positive projections generally signals a positive outlook for the company, potentially leading to increased investor interest and higher stock prices. Conversely, divergence in analyst opinions, with some projecting strong growth while others predict lower performance, creates uncertainty and may result in a more volatile stock price. Investors often use consensus projections as a benchmark, while recognizing the inherent subjectivity in any analysis, which includes accounting for any inconsistencies between projections and market realities.

- Specific Projections and Their Impact

Specific projections, such as revenue forecasts, earnings per share estimates, or growth rate predictions, have a direct bearing on the stock's valuation. Positive projections for revenue growth and profitability often lead to an increase in investor interest and a higher share price. Conversely, negative projections can trigger a decline in investor confidence, potentially driving the stock price down. For example, if analysts project a significant increase in Graze Robotics' sales of a new product line, it may spur investment. Alternatively, projections of declining profitability might discourage further investment in the stock.

- Analyst Ratings and Stock Price Correlation

Analyst ratings, often accompanying projections, influence investor sentiment significantly. A positive rating, often indicated by a "buy" or "strong buy" recommendation, often correlates with a higher expected stock price. Conversely, a negative rating, such as a "sell" recommendation, may result in decreased investor interest and a potentially lower stock price. Historical data relating these ratings and stock movement can assist in understanding this correlation and identifying patterns within the industry for investors.

In conclusion, analyst projections are a crucial factor in the market dynamics surrounding Graze Robotics stock. Understanding the components of these projections, their potential impact, and the correlation with stock prices, enables investors to evaluate the available information and make informed decisions. Consideration of factors like analyst consensus, the specific projections themselves, and the reliability of their assessments is vital for navigating the complexities of this particular market.

Frequently Asked Questions about Graze Robotics Stock

This section addresses common inquiries regarding Graze Robotics stock, providing clear and concise answers to help investors understand the factors influencing its performance.

Question 1: What are the primary factors driving Graze Robotics stock's price fluctuations?

Graze Robotics stock prices react to a combination of internal and external factors. Internal factors include the company's financial performance, product innovation, and operational efficiency. External factors encompass market trends, industry growth, competitive pressures, and overall investor sentiment.

Question 2: How does Graze Robotics' financial performance impact the stock?

Strong financial results, such as consistent profitability, revenue growth, and efficient cost management, typically lead to increased investor confidence and a higher stock price. Conversely, poor financial performance, like losses or declining revenue, often results in reduced investor interest and a decline in the stock price.

Question 3: What is the role of technological advancements in the robotics industry on Graze Robotics stock?

Significant technological advancements in robotics, particularly advancements in areas like AI integration and sensor technology, influence investor perception of Graze Robotics' competitive position. Successful adoption of these advancements can enhance profitability and lead to higher valuations. Conversely, lagging behind in technological adoption could negatively impact investor confidence.

Question 4: How does the competitive landscape affect Graze Robotics stock?

The presence and actions of competitors play a key role. Successful innovation or cost-effective strategies by competitors can put pressure on Graze Robotics, potentially impacting investor confidence and the stock's price. Conversely, maintaining a competitive edge through innovation or market differentiation can enhance investor confidence and drive the stock price up.

Question 5: How do analyst predictions and ratings impact investor sentiment and the stock price?

Analyst projections and ratings are a significant factor influencing investor sentiment. Positive predictions and ratings from financial analysts often generate investor interest, potentially pushing up the stock price. Conversely, negative predictions or ratings can lead to decreased investor interest and a lower stock price.

Understanding these factors is vital for making informed investment decisions. Always conduct thorough research and consider seeking advice from qualified financial professionals before investing in any stock.

Next, we will delve into the historical performance of Graze Robotics stock and explore potential future investment strategies.

Conclusion

This analysis of Graze Robotics stock has explored the multifaceted factors influencing its price fluctuations. Key considerations include the company's financial performance, the trajectory of market trends within the robotics sector, the impact of technological advancements, the competitive landscape, investor sentiment, the company's strategic choices, and the projections of financial analysts. The interplay of these elements demonstrates the complex dynamics of stock valuation. Sustained profitability, coupled with market growth and innovative strategies, is essential for long-term stock value appreciation. Conversely, external pressures, such as intense competition or economic downturns, can negatively impact investor confidence and stock prices. A thorough understanding of these variables is crucial for evaluating potential investment opportunities within the robotics industry.

Ultimately, the value of Graze Robotics stock hinges on the company's capacity to adapt to the dynamic environment of the robotics market. Continued innovation, strategic planning, and robust financial performance are critical factors in influencing investor sentiment and driving stock price appreciation. The future trajectory of Graze Robotics stock remains contingent upon the company's ability to remain competitive, meet market demands, and effectively manage challenges. Investors should thoroughly research and analyze the various contributing factors to make informed decisions about any potential investment.

Article Recommendations